Abstract

Siftwell Analytics, a company providing insights to community health plans to help improve member outcomes, has secured $5.8 million in the company’s first venture capital funding round.

Led by former Cardinal Innovations Healthcare CEO Trey Sutten and General Counsel Chuck Hollowell, the two co-founders are using their expertise in the managed care space to help members proactively using machine learning and AI.

VC firms AlleyCorp, Arkin Digital Health, Tau Ventures and The Charlotte Fund all invested in Siftwell for this funding round. The company will use the funds to enhance its products, Sutten told Fierce Healthcare.

Siftwell will look to address more areas of population health. Right now, Siftwell focuses on major conditions like COPD, depression, hypertension and obesity.

The company operates in four states: Idaho, Montana, Wyoming and North Carolina, with plans to expand into New Jersey and Arizona. The company has three clients including Mountain Health CO-OP and Alliance Health.

“As a payer executive for 15 years, I’ve seen dozens of data and analytic solutions, but none that repeatedly and reliably changed member behavior,” said Bill Georges, partner at AlleyCorp, in a statement. “We are thrilled to back this exceptional team of health plan veterans whose singular focus is on improving the way clinical operations teams within community health plans work. We see tremendous opportunity for Siftwell to augment these teams and improve the care for these most in-need populations.”

A closer look

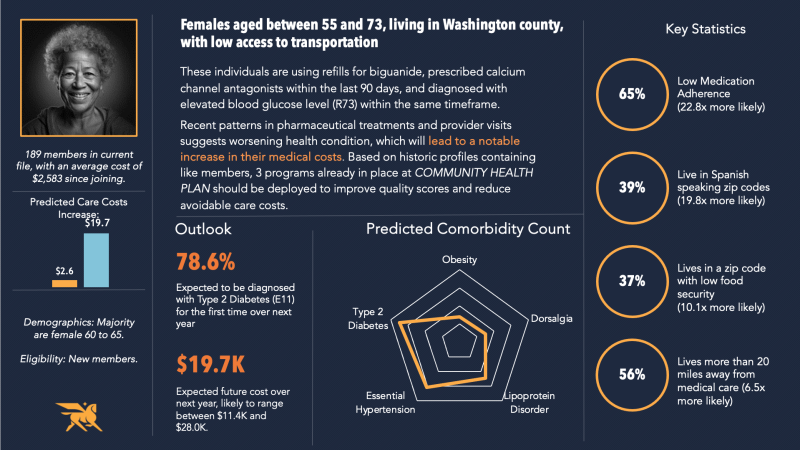

The company works to improve quality scores and cost profiles by identifying at-risk individuals who are likely to have emerging costs in the near future. Siftwell receives information like claims, health risk assessments and call center data from the plans. That data—which could include access to food, transportation, housing and employment—is stitched together with Siftwell’s datasets to run against machine learning.

Sutten says they can then identify patterns that traditionally determine whether a person is compliant with HEDIS quality score measures, such as if a person partakes in breast cancer screenings. Then causal inference and explainable AI is used to root out important details within a population’s subset to show what the plan can do next. The company is able to sort members into groups, letting AI take over to determine the best care.

“That’s kind of the magic of machine learning because historically it’s been more about humans using our experiences to set the parameters,” said Chuck Hollowell, President. “If we can use machine learning to find some of the other signals out there that humans wouldn’t have thought of and see it sooner.”

The data starts to highlight commonalities. For example, it can pinpoint 250 people with an 80% chance of noncompliance of cancer screenings because they live more than 20 miles from a screening facility, don’t have transportation and will need child care. Specific insight allows the plan to get into the mind of its members and deliver actionable solutions, like arranging for an Uber to pick the patient up and suggesting nearby childcare options.

Members get clustered together in very unique groups. In examples shared with Fierce Healthcare, one cluster included the members’ race, age, languages spoken, geographic county, mental health and nutritional problems.

“You study 48 months of data and say, ‘Based on this combination of claims and this combination of social factors [a member] ended up with an end state where somebody costs more money, got sicker and was not compliant,'” said Sutten. “Then you take that study of patterns and move it forward in time, and you say, ‘Who are the people that are exhibiting the first 12 months of that complex pattern? That’s when you begin to identify people that are at risk for some eventuality.”

Cost savings earned by these insights can be redeployed by health plans to other programs that need more funds, but plans are most focused on improving quality measure improvement and health outcomes.

The company also talked about defining data twins, where there are clusters of people that are virtually identical except for one intervention factor. One twin may have seen a primary care provider or received a certain health screening, versus the twin that didn’t see a provider. Urging these members to seek out a primary care visit is a simple solution for health plans to be more efficient.

“Then you’re really moving the needle in very precise ways,” said Hollowell.

Sutten believes these insights are game-changing to health plans that are not getting the most out of their data.

“When I think about certain populations, and certain plans that serve those populations, they’re just not using some of this technology,” he said. “I’m speaking from firsthand experience. I ran one of these plans. We were doing retrospective analysis. It was based on number of emergency department visits or cost thresholds.

“The technology is such that it’s accessible to smaller plans that are responsible for caring for kind of the sickest of the sick,” he added.

View the original article here.